- “समुदायमा समर्पित उत्कृष्ट वित्तीय सहकारी संस्था”

- 011-499160

- Pachkhal-4, Tamaghat, Kavrepalanchok

We provide various types of deposit accounts designed to help you save and earn while securing your future. Whether you’re looking to build a savings fund or invest for long-term growth, we’ve got the right option for you.

Savings Account: A basic account that allows you to save with easy access to your funds. Enjoy interest on your balance while keeping your money safe and secure.

Fixed Deposits (FD): A secure investment option where you can deposit a lump sum for a fixed tenure at attractive interest rates. The longer you invest, the higher the return on your money.

Recurring Deposits (RD): For those who prefer saving a fixed amount regularly. This plan helps you build a corpus over time with guaranteed returns at the end of the term.

Term Deposits: Similar to Fixed Deposits but with customized durations to match your investment needs, helping you grow your savings steadily.

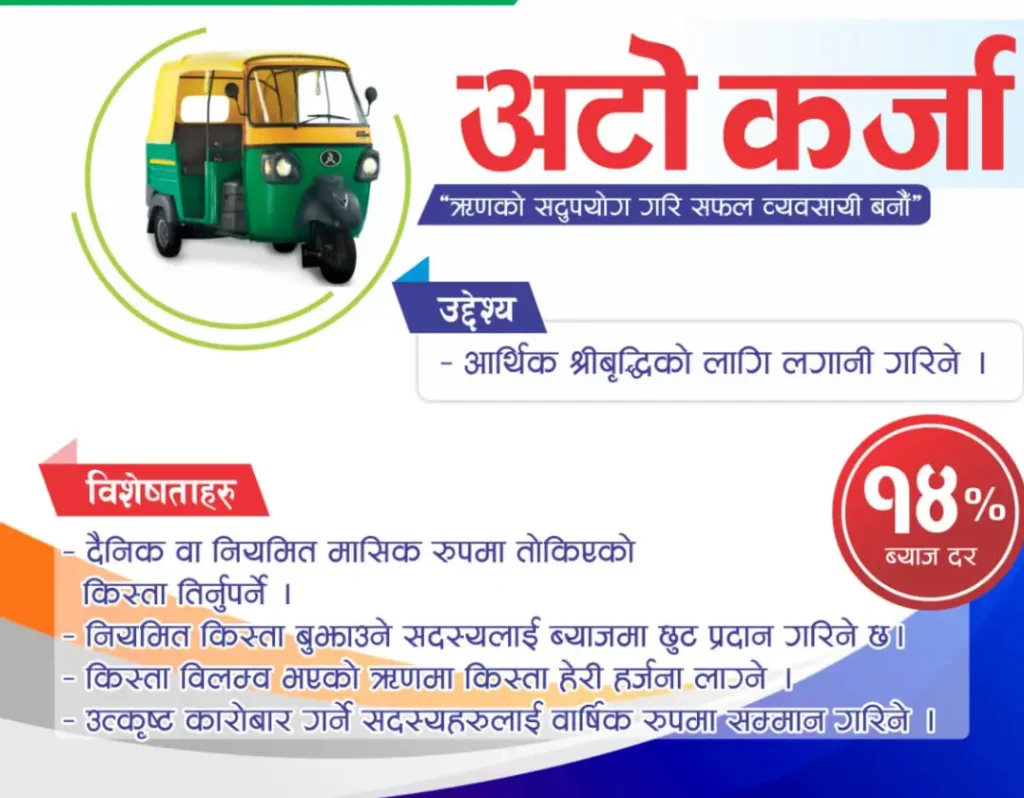

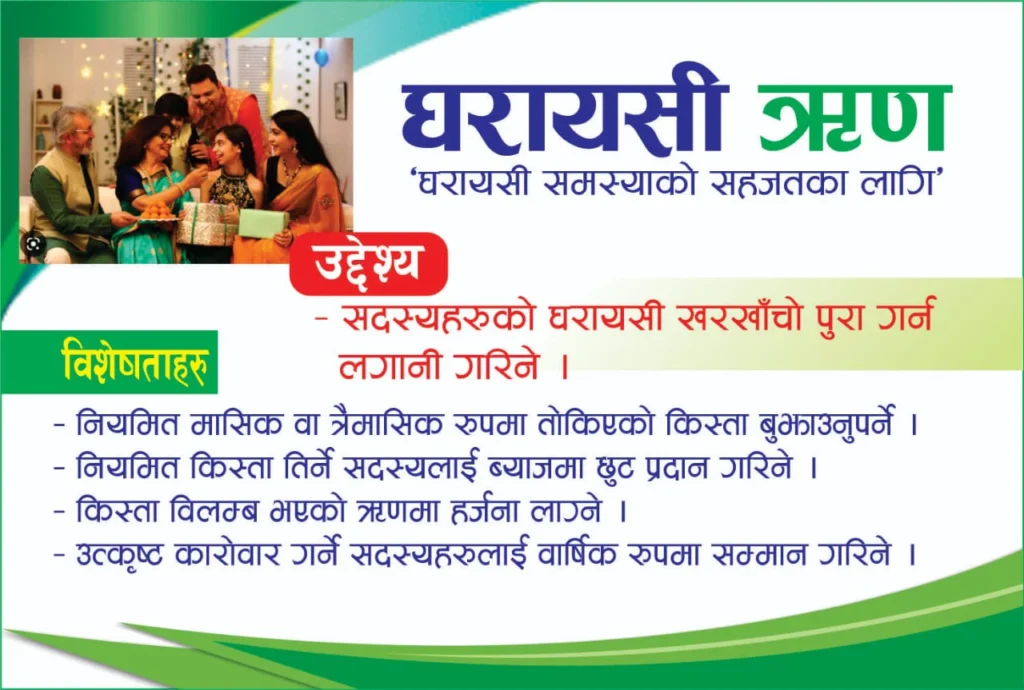

Our loan services are designed to help individuals and businesses access the financial resources they need at competitive rates. We provide a wide variety of loan products with flexible repayment terms, making it easier for you to achieve your financial goals.

Personal Loans: Whether you need to cover unexpected expenses, pay for education, or finance a family event, our personal loans offer quick and easy access to funds without heavy paperwork.

Business Loans: Designed to support entrepreneurs and small businesses, our business loans help you grow and expand with low-interest rates and flexible terms.

Emergency Loans: In times of need, our emergency loans provide fast relief to cover medical expenses, sudden financial crises, and more.

Agricultural Loans: We support farmers and agricultural businesses by providing loans to fund operations, purchase equipment, or invest in crop production.

Housing Loans: Helping you realize your dream of owning a home. Our housing loans come with affordable rates and long repayment terms.

We understand how important it is to send and receive money quickly and securely. Our remittance services provide you with hassle-free, reliable, and fast money transfer solutions both locally and internationally.

Domestic Remittance: Send money within the country easily, ensuring your family members or business partners receive it quickly and securely.

International Remittance: Our international money transfer services make it simple to send funds abroad with minimal charges and fast processing times.

Online Transfers: Enjoy the convenience of transferring money online through our secure and user-friendly mobile app or online banking portal.

We provide Bank Guarantee services to offer security and assurance in business dealings. Whether for bidding, contracts, or international trade, our guarantees provide financial backing and trust between parties.

Performance Guarantee: A guarantee that assures your business obligations will be fulfilled as per contract terms, offering peace of mind to your clients or partners.

Payment Guarantee: We provide a guarantee to ensure timely payment of debts or obligations, securing your reputation in business transactions.

Bid Bond Guarantee: Used in tenders and contract bids, it ensures that the bidder will enter into the contract if awarded, and fulfill all the terms.

Advance Payment Guarantee: Assures that if the buyer makes an advance payment, the seller will fulfill the contract as promised.

At Swaechha Saving and Credit Co-operative Ltd., we believe in empowering our members and the community with the knowledge and skills needed to make sound financial decisions. Our training programs are designed to improve financial literacy and encourage smart money management.

Financial Literacy Workshops: Gain a deeper understanding of savings, budgeting, and investment strategies through our hands-on workshops.

Loan Management Training: Learn how to manage loans effectively, understand repayment schedules, and avoid financial stress with our loan management sessions.

Entrepreneurship Programs: Equip yourself with the tools and knowledge to start and grow your business. From planning to execution, our programs cover the essential aspects of running a successful venture.

Online Learning Resources: We provide access to e-books, articles, and videos to help you learn at your own pace.

We ensure that all the services we offer meet the highest standards of quality and regulatory compliance. Our standardization efforts focus on maintaining transparency, consistency, and excellence across all our operations.

Regulatory Compliance: We adhere to national and international regulations to ensure our financial services are secure, fair, and ethical.

Quality Control: We maintain rigorous internal controls to monitor and enhance the quality of our services, ensuring our members receive the best experience.

Best Practices Implementation: Our team works continuously to implement industry best practices in areas such as customer service, loan servicing, and financial management to uphold trust and quality.

Certification Programs: We ensure that our staff and services are regularly evaluated and certified by industry-recognized authorities to maintain the highest standards.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Higher Returns & Security.

Business Loans

Higher Returns & Security.

Higher Returns & Security.

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| 3 | 6% |

| 6 | 7% |

| 12 | 9% |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| 1 | 1% |

| 2 | 2% |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| No data available | |

Such loans are invested in long-term projects and construction of physical infrastructure in large industries, markets, services, and productive sectors for the overall development of the cooperative sector of the nation.

| Month | Interest Rate |

|---|---|

| 1 | 2% |

| 3 | 4% |

| 5 | 6% |